Uncategorized

Uncategorized

Uncategorized

Uncategorized

Uncategorized

Uncategorized

Emergency Services Blood Challenge

1 June – 31 August 2022

Tally update: 1 July 2022

Thank you VICSES for your ongoing support of this challenge.

With many donors taking a well-deserved break and the colds and flu season upon us, your support in the past month is greatly appreciated.

Overall results so far:

How is VICSES tracking this year?

Between 1 – 30 June 2022 = 113 donations have been made so far

This equates to 339 lives saved so far!

For a more detailed overview of current results please visit our results page or refer to the attachment listing top 16 organisations.

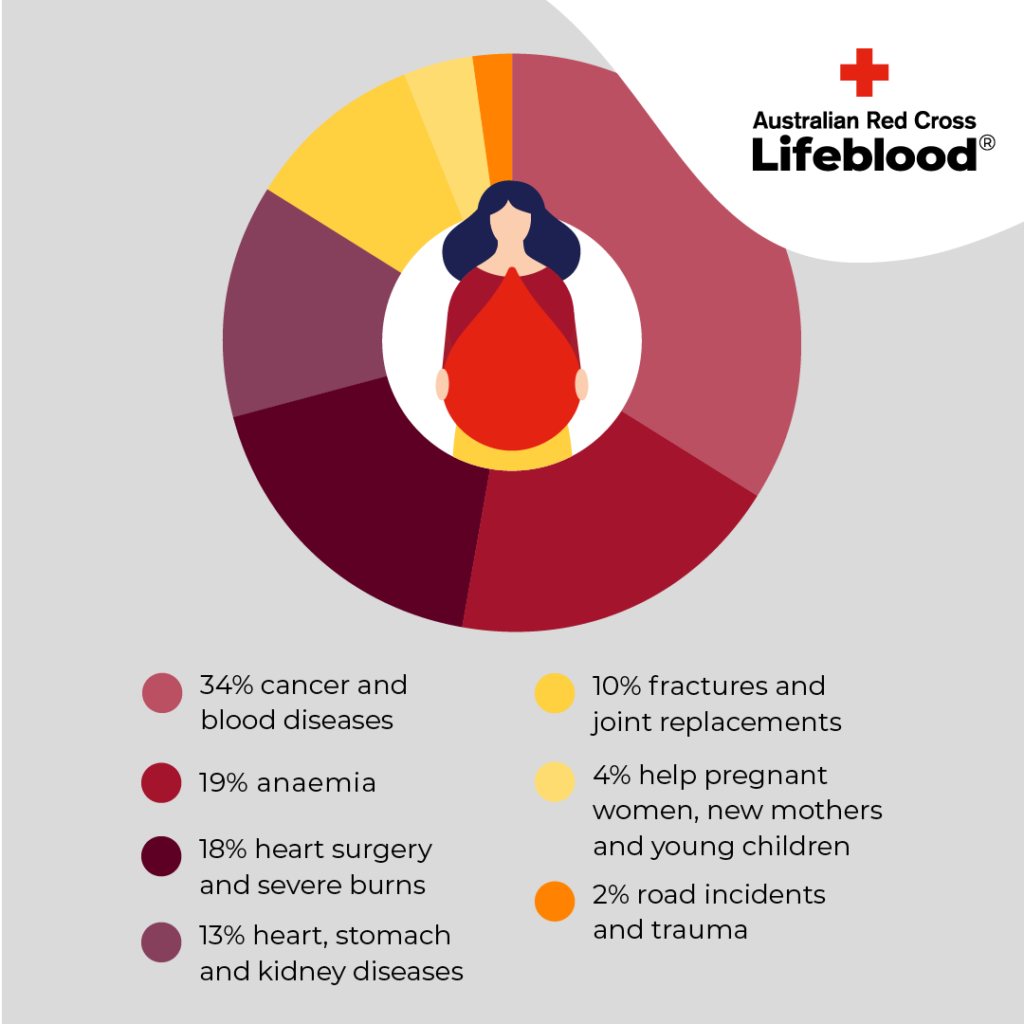

Where is blood used for?

For more information about where donated blood is used, please see below.

Once again, thank you for your support. Thank you for helping us save lives!